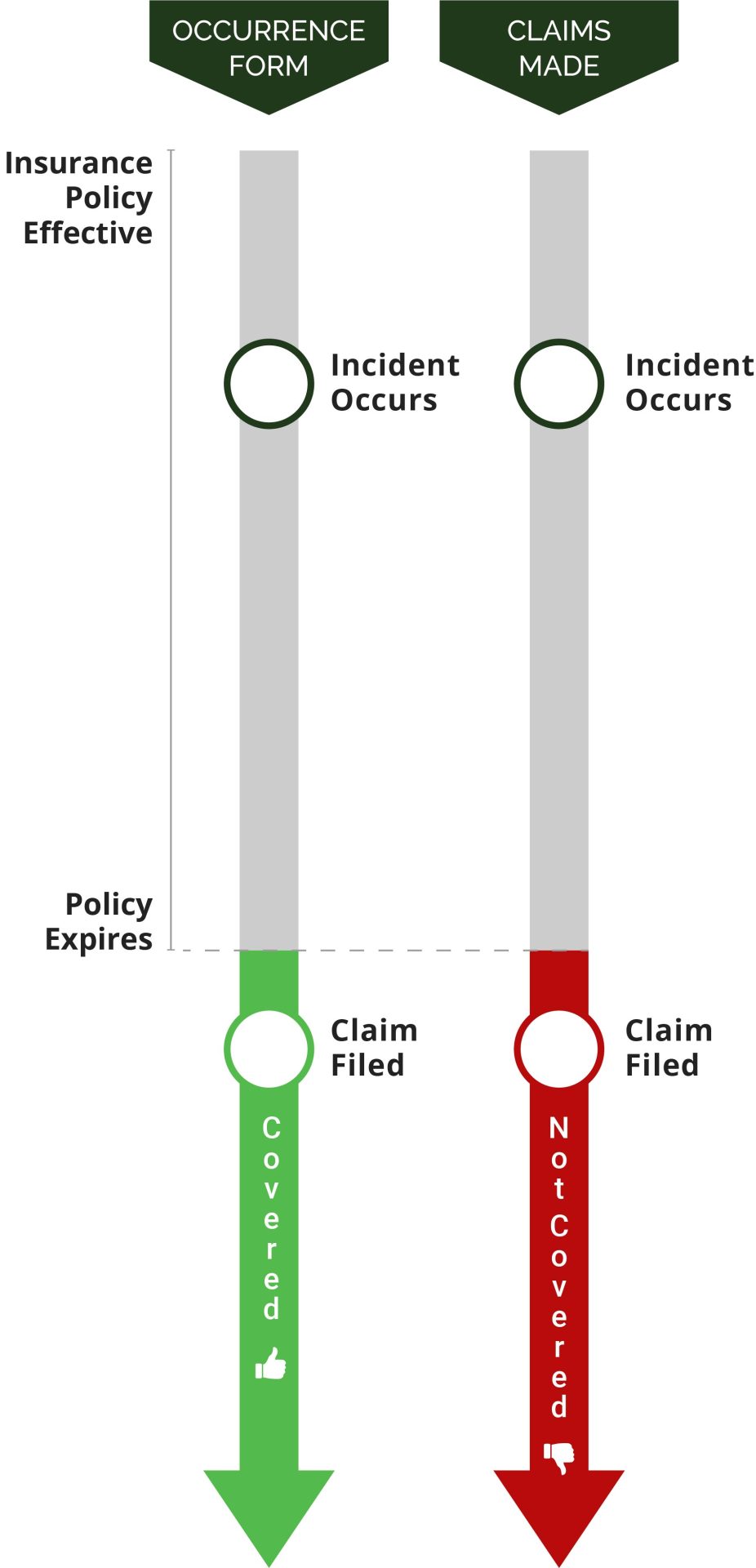

Occurrence Form vs Claims Made Liability Insurance

-Not All Professional Liability Insurance Policies are Equal-

It is not always clear which option to choose when selecting liability insurance, and some companies hide their policy details. We're here to clear the confusion when it comes to the different types of policies.

Get Occurrence Form Coverage with NACAMS

Occurrence Form is the industry-preferred policy type over Claims Made because you are covered for any incident that happened while your policy was in effect.

Additional Information

Occurrence Form Policy

Occurrence Form policies only need to be active when the incident in question occurs to trigger coverage, regardless of when it’s reported. In other words, any claim filed after an occurrence policy expires will still be covered, as long as the incident took place during the policy term.

Example: Your occurrence policy expired on Nov. 30, and you did not renew it. One of your clients experienced bruising after his acupressure session on Oct. 30, at which point you were insured. The client does not file a claim, however, until Dec. 30. You report the claim to your insurance provider and find out that you’re covered—even though your policy expired a month ago!

Get Occurrence Form Coverage with NACAMS Insurance Plus!

Claims Made Policy

Claims-Made policies must be active when the claim is reported in order to trigger coverage. In other words, any claim filed after a claims-made policy expires will not be covered, even if the incident in question took place while the policy was active.

Example: Your claims-made policy expired on Nov. 30. One of your clients experienced pain after her deep-tissue session on Oct. 30, at which point you were insured. However, the claim isn’t filed until Dec. 30, a month after your policy expired. You report the claim to your insurance provider only to find out that you’re not covered because the claim was made after your policy term.

Claims Made Policy + Tail Coverage

Tail coverage, also known as extended reporting period (ERP) coverage, responds to incidents which occur during the policy term but are not reported until after the policy expires. Claims-made policyholders may purchase tail coverage in order to extend their reporting period once it ends. On average, tail coverage costs two times more than the original term cost at the time of expiration.

Example: Your claims-made policy expired on Nov. 30, and you purchased tail coverage. One of your clients filed a claim on Dec. 30, regarding a massage session you performed on Oct. 30. You report the claim to your insurance provider and find out that you’re covered—even though the claim was reported after your policy expired!